Midyear Business Update

Around 2019, a broker in Georgia told us he wasn’t interested in telling anyone about how well we’d performed for his clients because he didn’t think we could execute our unique solution if we got bigger. He was wrong. We are about five times the size we were in 2019 and we have only gotten better. I understand the concern though. We give clients a high-end boutique feel where client and member service is prioritized over everything. We aren’t the most expensive RBP vendor, but we offer the most premium services where they matter. The level of attention and responsiveness brokers and their clients get from our staff isn’t something one would expect from a large player. I want to share with our partners what this growth looks like and reinforce our commitment to executing at the level they expect.

We continue to be the lone wolf in the RBP space that remains family-owned with a singular focus on network replacement. Our passion and our tone often strike people in a way that leads them to believe we are a startup trying to claw our way out. It is misunderstood and people mistake our tenacity to do things right for behaviors of survival. I’m guilty of throwing out those misleading vibes, so let’s pull back the cover a little this month and share with our partners what the growth looks like and how we maintain our high level of performance. We will not be like the others that grew too fast and alienated their fans with subpar service.

Where are your other clients? I get asked this by clients and broker partners all the time. It’s natural for them to be curious as they hear about our growth. I don’t have anything profound to share about this, but here is the distribution of members we serve by ZIP code. The Western states may look a little sparse but, for perspective, compare it to a map of the U.S. at night, and it will make more sense.

Claim Auditing

Being family-owned with exceptional office culture doesn’t make us a mom-and-pop shop. I get the sense a big surprise to visitors is the scale of our operation. As they meet folks, they realize it’s not just the number of people it’s the breadth of expertise across the departments. Out of our 145 employees, you’ll usually find about 125 in the office each day fully dedicated to executing network replacement — audits, claims processing, IT, account management, member advocacy, quality assurance, training, balance bill support, provider contracting, sales, marketing and legal. Staff is great, but what is the output?

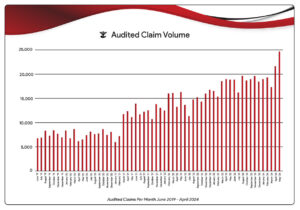

We really pound the drum that steady growth with the right partners is the optimal path to success. We define success differently than the blue bloods worshipping dollars in our space. We define success as giving plan sponsors and members the best opportunity to be successful without utilizing a traditional network. Period. We need growth, revenue and profitability to achieve that, but reinvestment of almost 100% of retained earnings instead of paying out investors has been our catalyst. Here is a chart showing our audited claims processed by month over the last five years. The most important thing for our partners to understand is executive compensation has been relatively flat over this entire period. Revenue growth isn’t getting a handful of people rich, it’s the fuel that powers our talent acquisition and innovation.

The chart also gives our partners insight into how we execute a smart growth strategy. We set caps on new business each sales cycle and we hire out ahead of new business. We also aren’t afraid to cut bad clients. Bad clients drain resources and negatively impact provider relationships — two things that take away from the experience of our other clients, so we must protect all of you from that. There was a sales rep for a competitor bragging about taking 40% of our business back in 2022-23. He was foolish back then and apparently this is still his Occunet-over-ClaimDOC sales pitch. They did accept a group of clients (not even near 40% as you can tell from the chart) from a program after we proactively terminated it. One of the most aggressive and best moves we have made as a company was terming that program and trusting our sales team to seamlessly replace them with clients that would better align with our other clients. Pruning the shrub is a pretty simple concept but one those chasing dollars or satisfying investors are blind to. It’s about health, not wealth.

Pave the Way Update

Audit numbers provide insight into smart growth, and our Pave the Way output gives you a chance to see where the rubber meets the road. The bulk of the clients that have migrated to us from both traditional networks and RBP competitors have done so based on our commitment to driving access without relying on contracts. The question is whether that is a sales pitch or whether we deliver on that commitment. You’ll see in this chart that we don’t just talk about it, we deliver on it.

Corporate Office Renovation

Pave the Way is an intensive and expensive endeavor, which is why there isn’t another competitor willing to invest in their member experience like we do. With growth and the full utilization of Pave the Way, we will be busting at the seams on our main floor in West Des Moines. Based on business already committed for future effective dates and target net growth of 15,000 employee lives, we started a building renovation in June to create more office space at our headquarters.

When we started the process of purchasing and designing the existing property back in 2020 we had around 50 employees. We designed the main floor of our office to house about 130 employees and we expected that to fill up over five years. We moved into the office June 2021, and we are hitting those numbers at three years instead of five. We held back about 9,000 square feet of shell space in our lower level that is now under construction. When that’s complete, it will allow for 45 more employees under this one roof. There were cheaper options, but we believe this was a necessary investment to maintain the standard that’s been set by our staff. As always, we welcome anyone to visit our office any time.

When we started the process of purchasing and designing the existing property back in 2020 we had around 50 employees. We designed the main floor of our office to house about 130 employees and we expected that to fill up over five years. We moved into the office June 2021, and we are hitting those numbers at three years instead of five. We held back about 9,000 square feet of shell space in our lower level that is now under construction. When that’s complete, it will allow for 45 more employees under this one roof. There were cheaper options, but we believe this was a necessary investment to maintain the standard that’s been set by our staff. As always, we welcome anyone to visit our office any time.

Our client base is in a really good place right now — well-diversified by size, geography, industry and distribution partner. We are in no rush to grow, but our solution is more popular than ever, and we are dealing with a massive pipeline of new business. Our commitment remains to existing clients that we will never sacrifice service to chase growth. We have proven our staff stays true to that commitment and our foundation of peer-to-peer accountability will continue to drive our ability to deliver. ClaimDOC is a Rocky IV remix. Like Rocky Balboa, we will always fight with the spirit of an underdog, but we are giving staff the resources provided to Ivan Drago. A fighting spirit and superior resources — both essential to honoring the commitment we make to clients.