As Data Breaches Surge, Is Employee Information Safe?

Cybersecurity threats to sensitive customer and financial information should not be a new topic for anyone. Whether you are a broker or an employer, the headlines on data breaches are common these days. Despite the threats and the juicy stories on celebrities getting hacked, it still seems like a lot of people have their head in the sand regarding how serious this threat is for plan sponsors offering a health plan to their employees.

A couple years ago, I started regularly sharing data on security threats with leadership and they quickly became obsessed with the information. They were deeply invested. The attacks on our systems are constant – not weekly, daily or hourly – it’s a relentless assault. Headlines within our health insurance space are becoming more and more common:

- Change Healthcare experienced a ransomware attack in February 2024 that potentially exposed the personal information of 190 million individuals.

- Imagine360 reported three data breaches over the last few years:

- Recently reached a settlement on a breach from 2023

- Most recent breach occurred in January 2025

The intent of this article isn’t to scare you it’s to make you knowledgeable about the world we live in. It is meant to share the scope of the threat, the type of threats and how security threats should impact your vendor decisions.

Let’s look at our own security statistics to help you digest the information.

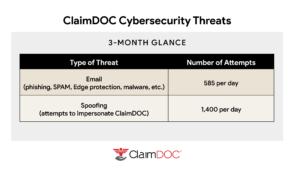

You are looking at a relentless effort by cyber criminals to get their hands on any type of information they can leverage to harm businesses and individuals. We leverage security and compliance solutions across the entire enterprise – cloud applications, data protections, identity, endpoints and Office 365. These security systems operate 24/7, which leverage both systematic defense and alerted human intervention to block intruders.

Locking down email and putting an emphasis on security is essential to protection. Based on the number of threats and vulnerabilities, this is the most critical aspect to security for most organizations. ClaimDOC gets hit with more than 2,000 threats each day.

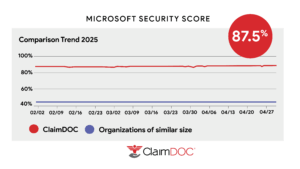

ClaimDOC holds a Microsoft Security Score of 87.51 and, as you can see, the average score for an organization our size is 43. Leadership is very proud of this score. This isn’t just based on my expertise or Jayson Hansen’s hard work as the infrastructure engineer, whose sole responsibility is managing our Office 365 solution. It’s the entire company continuously adjusting to the demands of new security protocols. Obtaining and maintaining our security score reflects how deeply invested everyone at ClaimDOC is in protecting client data.

The first and most basic step you can take to ensuring your vendors are secure is requesting their Microsoft Security Score. Every Microsoft Office 365 customer has one and you should ask them to share their live security score in a verifiable way.

Along with email, protecting systems and other portals of information exchange are critical. The threats include everything from firewall attacks, password guessing via brute force or spraying, and malware from websites. Preventing breaches within these systems is built on proactive defense. Our security averages about 650 blocks per day and the keys to success include:

- Top-tier configuration

- Multiple layers of defense

- Zero Trust Architecture

- Limiting internet use to business activity

- Comprehensive security policies and remediation plan

- Threat detection and threat hunting mechanism built by specialized experts in the industry

- Vulnerability management

- Penetration testing

I joined ClaimDOC in 2020 and, prior to that, I was consulting for them. When we began this journey together, my directive was to build out systems and infrastructure with a Fortune 500 feel. While we have achieved that throughout the ecosystem, none of it matters more than our cybersecurity. We have never won a single piece of business because of our investment and efforts in this space, however, I believe the day will come when we will get business due to the failure of others.