What About the Members?

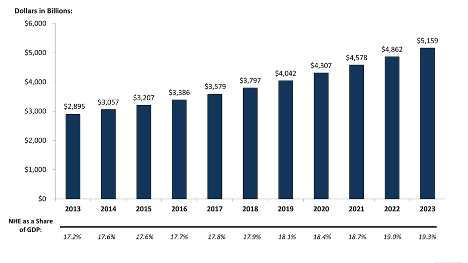

SOURCE: Kaiser Family Foundation calculations using NHE data from Centers for Medicare and Medicaid Services, Office of the Actuary, National Health Statistics Group.

It’s no secret that healthcare costs in the United States are spiraling out of control, the chart above proves it.

When a carrier delivers a 14% increase at plan renewal, a broker typically can negotiate that down to 11%. With some plan changes, they get it down to 8% and feel pretty good. They found a percent that fits within the CFO’s budget. Job well done, see you next year.

But what about the members that populate the plans we write?

A RAND study showed that middle-class Americans’ pay has stood still for the last 20 years, and healthcare costs are to blame. The 8% increase in payroll deduction, or more depending on whether the employer was willing to take on an 8% increase in their portion, is a big bite. Americans rarely see their pay increase due to higher payroll deductions for their health plan and out-of-pocket expenses when they seek care.

Survey after survey has revealed that employees’ number one “ask” on their health insurance is for lower premium costs. The desire for lower premium costs is ahead of network changes, out-of-pockets, and certainly more important to them than the insurance company logo on their ID card.

Like you, I have been in those enrollment meetings listening to administration tell workers that, once again, their payroll deductions are going up, and their high deductible health plan (HDHP )is going from $2,000 to $2,500 or $5,000 if you have dependents covered. And, yes, the employer’s contribution to the health savings account (HSA) stays at $500.

At these meetings, employees shake their heads and most, in disgust, throw the plan information straight into the trash. They don’t have $2,000-$5,000 and no idea how to pay their bills if they get sick. At the end of the meeting, someone will say something like, “I’m not taking the medications my doctor prescribed because I can’t afford them. Is there anything I can do?”

It’s painful.

I should say, this was painful. Since I discovered reference based pricing (RBP) I have been the bearer of much better news.

The most gratifying part of my job is meeting with employee groups and showing them plans with lower copays, lower deductibles, and much lower payroll deductions. Many of our clients have ditched the HDHP their employees hated.

Let’s face it; there are plenty of levers to pull in the quest for lower health insurance costs—virtual medicine, direct primary care, centers of excellence, and drug rebates, to name a few. Several health-tech firms are springing up to rein in costs on specific treatments like musculoskeletal, transfusion therapy, imaging, the list goes on and on. Some do a terrific job.

The sledgehammer, though, is reference based pricing. No other approach takes on healthcare directly and generates the savings that RBP does. Those other programs don’t even come close.

Full disclosure, I’m a true believer in RBP. I can’t understand why every employer doesn’t adopt this plan. Or at least offer it as an option alongside a legacy network-driven plan.

For me, it’s all about the members and their families. The chart at the top of this article clearly shows that healthcare costs will continue to accelerate, and that’s going to cause our clients’ employees pain. ClaimDOC’s reference based pricing health plan is the way to relieve their suffering.