Stop Paying More for Less

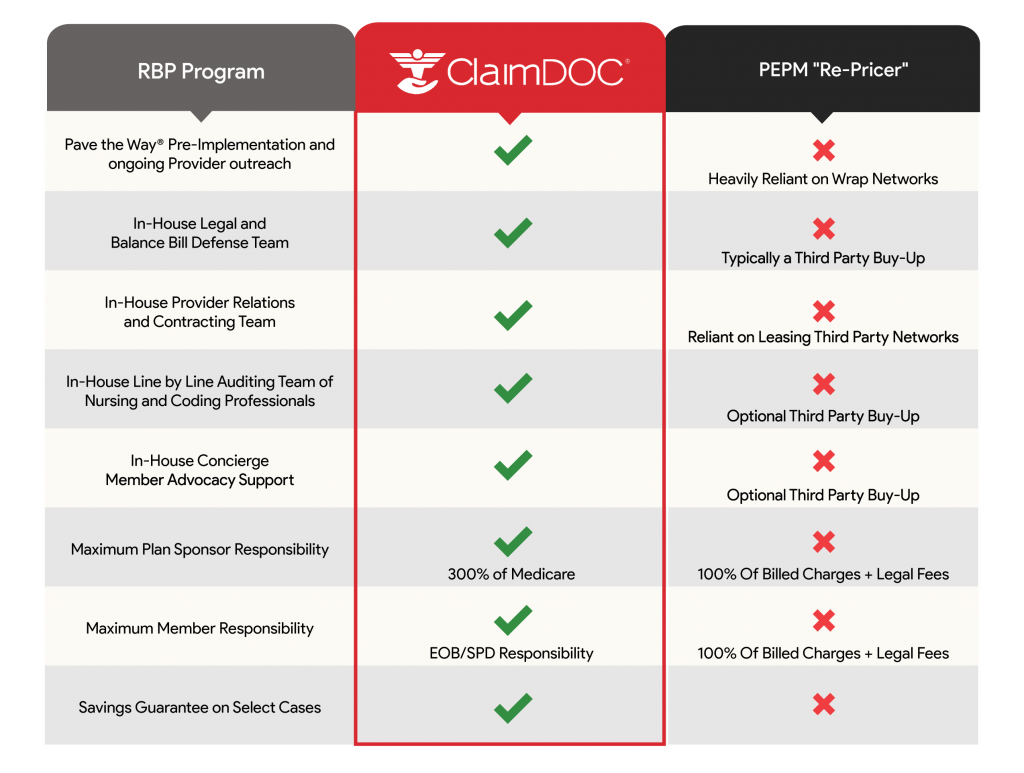

There is an abundance of non-fiduciary reference based pricing (RBP) vendors who charge a fixed cost per employee per month (PEPM), aka “repricers.” Repricers have convinced the employee benefits industry they provide employers the same capabilities and resources as co-fiduciary RBP vendors, such as ClaimDOC, for a fraction of the cost.

A simple cost comparison of ClaimDOC’s services tell a convincingly different story. After interviewing dozens of stop loss carriers, TPA partners, and insurance advisors there was no evidence to support the claim PEPM reference based pricing programs are less expensive. We also found they don’t work as promised and are unable to compete with ClaimDOC’s co-fiduciary RBP solution.

Trusting Your Reputation with Discount Service

The top repricers outright lie about the internal support and resources included in the PEPM fee. They downplay the absence of co-fiduciary indemnification which is a critical component necessary for a successful network replacement. Often a PEPM misleads buyers about the value of third-party á la carte services such as legal guidance and concierge member support, to fill the holes in their private equity owned RBP health plan time bomb.

The other Achilles’ heel of the PEPM is their over reliance on wrap PPO networks. They have no plan to ensure provider acceptance if they lose access to a competitor-owned network such as Private Healthcare Systems, Inc. (PHCS). We are the only program in RBP that solves this problem. Our Pave the Way program creates member access to physicians of their choice at a 90% success rate.

After one or two years with a weak repricing program, clients inevitably return to their traditional network solutions where they and their members overpay for services. Unlike the PEPMs, ClaimDOC does not rely on gimmicks. Advisors and employers need to understand the differences and value of our unique fair payment solution. The nuances of our program create factors that are more important than single-year savings. Detailed audits supplemented with multi-factor pricing, proactive provider education, and deeply connected in-house service and support delivery all result in long-term liability control and program satisfaction.

Understanding ClaimDOC’s Percent-of-Billed Fee Structure

ClaimDOC’s fee structure utilizes a variable percent-of-billed charges with per-claim fee caps. Our fees are considered part of the paid claim itself and accumulate toward the stop loss specific and aggregate deductibles. Therefore, fees are paid to ClaimDOC out of the plan claim fund or by the stop loss carrier for claims exceeding specific and aggregate deductibles.

Stop loss carriers favor ClaimDOC’s fee schedule because of our strict fee caps and low percent-of-billed-charges model. We are generically quoted as 10% of billed charges, however, that should be viewed as a max. The blended average of fees across all clients in 2021 was under 7%, which reinforces our modest sales approach.

ClaimDOC Fee Schedule – Fully Bundled Pricing – No Upcharges

- Uncontracted – Physician claims over $2,000 and ALL facility claims

- 10% of billed charges up to per claim fee cap of $25,000 for scheduled procedures

- 10% of billed charges up to per claim fee cap of $50,000 for emergency claims

- Contracted – Physician claims over $2,000 and ALL facility claims

- 6% of billed charges, same fee cap structure

- Dialysis Treatment – $1,000 per invoice fee cap

- FREE – PHYSICIAN CLAIMS UNDER $2000

- All legal and balance bill support is included, even though we don’t charge.

Lower RBP Fee with More Overall Spend –

Winning a Battle and Losing the War

In this comparison, the annual plan spend for ClaimDOC’s comprehensive complete network replacement solution is less than the average PEPM referenced based pricing program. Our fee is captured in the claims spend. Underwriters may increase the expected claims spend due to our fee, however, they give us more credit for controlling provider payments. This underwriting credit along with the repricers PEPM fee added in makes our program less expensive. Paying more for less with unlimited exposure is the reality of PEPM reference based pricing.

Download: ClaimDOC vs PEPM Cost Comparison

ClaimDOC resisted market pressure five years ago when most change agent brokers were first trying RBP. PEPM looked great on paper and in presentations. These brokers were burned and now value our full-service solution. We rarely meet someone who had a salvageable experience, and the PEPM vendors are left looking for new blood. I would challenge any experienced PEPM proponent to come forward and prove how their model saves on total plan spend versus ClaimDOC.